Dolla Dolla Bills Y'all

Is there still room for innovation and category design in one of the fastest growing segments in retail?

The setup

We’ve all been to them. Chuck a coin in any direction of a strip mall in suburbia and it’s likely to fall on the doorsteps of a dollar store. Inside the temple of dollar(ish) deals you’re likely to find Mid-West moms loading up on tawdry holiday decor and tweens feigning their sugar addiction. In my city of Montreal you’ll find the iconic green and yellow Dollarama (CAD $23B market cap) banner on damn near every corner on every street. In a country of with a population less than that of the state of California you’ll find 1,400 of them, that’s 1 Dollarama per 27,000 persons.

The first Dollar General opened in 1955 to a street mob enchanted with the new concept, imagine the lineup at a Footlocker dropping the latest Air Jordan, but in 1955.

Dollar General, the largest of the North American players has market cap of $57B. Hot on their heels is rival Dollar Tree which is rapidly growing with a 5-year CAGR of 18% and has had quite the run up since their public debut. The company has around 15,000 stores (including its second brand Family Dollar) and plans to open an additional 600 stores by early 2022.

Whether or not these Discount, Dollar and Variety stores are actually cheaper on a weight or volume basis as the same/similar products sold by Amazon, Krogers, Walmart and Target etc. requires a deeper investigation (see chart below). And the actual amount of items sold for a dollar are shrinking. Nevertheless, the average American (me included) has far too much to worry about in the expensive world we live in to think twice about whether or not a dollar store is the best place to get a deal. The dollar store category over simplifies our already highly complex daily lives by giving us 10,000 sq/ft of discount nirvana just 5 miles from our doorsteps, a calming sense of safety that no matter how much fear we have about paying off our bills we can always afford a basket of goods at the dollar store. Today, nearly 75% of Americans live within 5 miles of one of Dollar General’s 17,683 stores.

While you’re not likely to bump into Elon Musk or Jeff Beezos picking up some kitty litter anytime soon at a Dollar Tree, you shouldn’t be surprised that 88% of Americans shop at least on a sometimes basis at these dollar stores. To little surprise, die hard dollar store customers, 54% of weekly dollar store shoppers, earn less than $60K annually and live in rural or suburban areas and rack up a staggering shopping tab of drum roll please…………$12.

And while high profit margin’s are clearly not the name of the game in the dollar goods business gross merchandise volume (GMV) is. In the U.S, Dollar and Variety stores generate $100B in annual sales with no end to growth and arguably continues to perform strongly even in a recession environment.

Not everything is a complete steal in dollar land. As I alluded a bit earlier dollar stores play up their low prices and in reality there aren’t that many dollar items to choose from anyways (dollar items are now $1.25 on average thanks to inflation and supply chain issues). One way dollar stores play with the cost-value savings formula is by creating smaller sized product options, take for example the cereals below.

The simple truth is that certain items in most dollar stores are in fact cheaper than Walmart or Costco, but you have to do the analysis on a unit by unit comparison. You often will find cheaper goods at dollar stores, think party supplies, disposable paper products, spices, art/craft/hobby supplies (see chart below courtesy of Chime).

Here is where things get a little darker. Dollar stores arguably wreak some degree of havoc on local communities, especially the rural ones. I would imagine this argument is no different, albeit extremely valid, than Walmart’s impact on local mom and pop retailers. The major difference here is that dollar stores require far less CAPEX and time than a Walmart does from a cost and lease signed to days to open rate and spread like cancer once the first is opened for business. The average walmart is almost 180k sq/ft and is home to over 40K SKUs. Meanwhile the average dollar store ranges 6-10k sq/ft and houses 7-10k SKUs. And once these dollar stores have an anchor in a community they immediately start shelling out dirt cheap, shiny and colourful bags of Plastic #5 filled with highly addictive salt, fat and sugar. Why buy a medley of garden variety of vegetables when you can have family sized bag of Flaming Hot Cheetohs (the best kind ;), 1L of orange soda and some candy bars for 1/3 of the cost (seriously, we all know which of the two choices wins on taste right?). I mean come on, who hasn’t emotionally binge ate King Sized Cookie Crunch Kit Kats, a family sized bag of Takis and a bottle of Mountain Dew Baja Blast to wash it down while watching an entire season of The Office. Okay, so Dollar Stores might readily encourage early on-set type 2 diabetes.

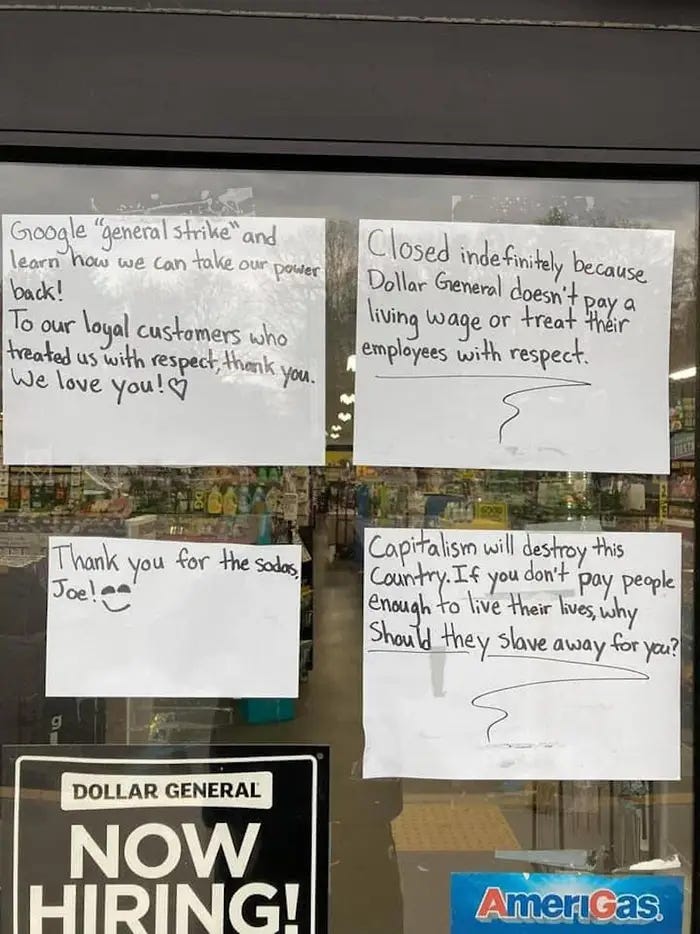

What else is systematically troublesome about these stores you ask? Well, it’s pretty clear that the model is predicated on cost cutting in every way possible and so why expect anything less when it comes to the staffing practices of these stores. Employees often emphatically rage that their stores are understaffed, un-humanly amounts of physical labour are expected of each worker and wages are far from livable. The rise of the self-checkout and store automation ensure that these stores never need more than a small handful of workers on site at any given time, hardly making the tiniest dent on rural labor economies. Have you ever actually gotten help in one of these stores? Anytime i’ve ever tried to find an employee they run the other direction as soon as they see my lips stumbling to find the words “Do you know where….?”

The competitive landscape

Can a challenger emerge with a big hit idea in the dollar category or is the market over saturated? Obviously I believe there is still an enormous opportunity for smart entrepreneurs to start a company that challenges incumbents, but before I go into how an upstart can find a unique value proposition, competitive go to market advantages and paths to scale and profitability I lay out the competitive landscape to provide a deeper understanding of the market opportunity at large.

Incumbent Dollar Stores

These players are showing incredible 4-wall (store growth), but appear to put far less emphasis and effort on local e-commerce, largely because these brands spend little to no money on marketing and customer acquisition. These players cary both consumables and non consumable goods and have strong assortment and well established brands. In these stores product quality is low,price is low, variety is high. None of them go very deep in any single product category.

Dollar General

Dollar Tree

Family Dollar

Dollarama (Canada)

Poundland (UK)

Daiso (Japan)

Internet-first dollar/discount e-commerce players

Wish.com (marketplace only, low trust, gawdy tchotchkes) (Generates north of $2B/yr in GMV)

Wish.com is the dollar store that in my opinion had tremendous potential but simply has not executed to their fullest potential

Copy-write infringement, longer delivery times, poor product quality

Pros include massive assortment, 3rd party seller model that scales nicely, higher margin revenue since they dont hold inventory or warehouses.

Shein (Discount fast-fashion chinese E-commerce juggernaut with customers in 220 countries, valued at $100B). Items range in price from $5 and up. Company buys wholesale and re-sells.

Aliexpress (Market place only, long delivery times, low trust)

Hollar.com (defunct, liquidation re-seller of brand names)

Brandless (defunct. All products are branded brandless, focused on health and wellness consumables initially, expanded to cheaper every day essentials, poor quality and higher cost than dollar store staplees.

Merchandising/Product Design Focused Dollar Stores

Flying Tiger (Design centric everyday essentials for Europe). Flying Tiger generates around $570M Euros in annual gross revenue and has 900 stores)

Pros: nice store design, well merchandised, single brand, price range is well executed, strong e-comm

Cons: Limited categories, lack of variety, no food/replenish-able supplies

Miniso (product licensing of entertainment brands). Miniso has 3,500 stores in 79 countries and generates USD $2.5B a year in gross revenue.

Pros: Strong merchandising, nice store design, single brand, decent quality for price

Cons: Few product categories, lack of variety, poor e-comm, limited food/replenish-ables

Miss A (Beauty and Cosmetics focused). 25 Stores.

Pros: Strong retail and online, hyper focused customer, well executed

Cons: Limited to cosmetics

Merchandising/Product Design Discount Brands

Amazon Basics (everyday essentials with Amazon logo slapped on it). Good quality. Higher cost, price range is wide.

Muji (Basics brand with timeless designs. prices range is large from $1 pens to $100+ furniture (lower cost, higher quality). large sku assortment.

Kirkland Brand (Major brands wholesaling with Kirland logo slapped on it)

Ikea Market (No not ikea, the market specifically, you know that part of Ikea where you buy plates, glasses, plants, picture frames, lights and accessories?)

Arteza (arts/craft supplies). Focus ion art supplies and crafts for hobbyist. Sell directly through their website and on Amazon. Products are typically 20-30% cheaper than higher end art brands.

Decathlon (discount sporting goods under various house brands owned by Decathlon, a personal fave of mine)

The hit idea

As seen from the extensive list of players, the dollar and discount variety segment is chock full of intense competition with tons of well established heavy hitting incumbents and a graveyard of failed companies who gave it their all but ultimately couldn’t cut it. Nevertheless, people’s desire for deals is a value proposition that will never go out of style. The trick is finding an economic model that can be profitable and sustainable and fills a need largely being unmet. With inflation soaring and the costs of everything going up and up (consumer goods, education, healthcare, home ownership, rent, etc), I do not see a cap to the number of successful players in the discount goods category. Here are some ideas I think with the right team and execution have the potential to be big hits that generate over $100M in gross revenue a year!

A Dollar Store for DIY/Rennovation

Similar to how Miss A built a successful omni dollar store brands (retail and e-commerce) specifically for the beauty and cosmetics category, I see a similar opportunity to create new specialty dollar stores that encompass massive consumer-categories. The main driver behind this idea, either it’s sheer genius or complete crap, stemmed from a time I went shopping at HomeDepot for DIY supplies and I racked up a $200 bill on a small paper bag of goods like: sand paper, a plastic drop cover, a box of 18 heavy duty garbage bags, a flimsy painter tray, 2 paint roller heads, 1 tube of caulking, small container of fast dry spackling, small box of drywall mud, box of drywall screws, compound and painters tape.

As I was furiously putting these expensive items in my shopping cart I knew that a good number of these items could be purchased at the dollar store, I also knew that the quality of those items were absolutely donkey poo. The $2 and $4 paint brushes I buy from the dollar store always leave behind hundreds of fibres from the paint brush. The painters tape from these dollar stores always gets stuck on the wall and causes me more work than if I didn’t use the tape to begin with. Or the time I was using a dollar store putty knife and it snapped from a little downward pressure from trying to apply drywall mud. No dollar store has ever claimed to be of superior quality, that said I am convinced that someone could build a successful dollar brand for discount tools, building and DIY related projects.

My curiosity of this amazing quality dollar store for renovation kept playing in my head like a broken record, so I began to entertain it a bit further. I rushed to Alibaba when I got home that day and started a search of 100 SKUs from Home Depot and 50 from the dollar stores. I was delighted to find hundreds of manufacturers with various certification and positive reviews selling many of these items at a much higher quality than being sold in those stores, with customizability and branding capabilities. I then played around with the various assumptions for the minimum purchase quantities, landed costs, etc and concluded that it is absolutely possible to build an assortment of higher quality and lower cost products for the home renovation space. “Handy Dollar Dan” (The fictitious name for this brand) could be a real viable business I thought.

What really killed me was the 3 mil heavy duty construction garbage bags. Home Depot sells boxes of these for $16-20 depending on the brand. These same bags can be purchased for pennies per unit, and can be shipped by the container load. I also don’t see a need to have them shipped in the heavy duty card-box boxes that they are sold in today, this simply creates more unnecessary waste and extra shipping weight. I would have them zip tied or banded into roles of 10 or 20 bags per roll. This type of clever thinking can be applied to thousands of products. I also imagined a purchasing process that would require meticulously testing of each product before choosing a vendor and then backing each item sold with a consumer friendly guarantee and return policy.

In terms of types of products “Handy Dollar Dan” would sell an assortment that covers building materials (5lb bags of cement, pre cut wood that is easily transportable, off cuts), tools and tool storage, drill bits, ceiling fans, saw blades, screws nuts and bolts, paint and painter supplies, Handles/Knobs, Faucets, protective equipment, finishing pieces (hooks and racks),home organization kits (think closet and storage build kits), lighting, liquidation tiles and flooring, basic plumbing, basic electrical, gardening and outdoors, and maybe some custom hobby kits for DIY builds. I see an opportunity to have simple price points, under $1, $1, $5, $10, $15, $20. There might be 4 types of hammers, a $5 Hammer, $10, and $15. Each hammer has a slightly different style and the higher price point you go the better the quality.

The Brand

I think there is an opportunity to build this dollar brand for young families in their 30-50s living in urban areas. HomeDepots are harder to access in urban settings because of their space requirements. I think there is an opportunity to target the renter, town home owners, condo owners, and property managers scraping for pennies. These customers are more likely to do aesthetic type work, basic renovations and smaller DIY projects. The brand value proposition is A) Cheap + B)Better Quality/Assortment than dollar store + C)Convenient + D)Better shopping experience. Success for my customers looks like reducing what they would have spent at Lowes or Home Depot by 40-50%.

I know what you’re thinking, retail is expensive and impossible to scale. I agree retail is tricky, but who said this is a pure retail play and who said retail cant be profitable with a smart e-commerce strategy. I see “Handy Dollar Dan” being omni-channel. Stores help create local brand awareness, drive a lift in e-comm sales and create brand familiarity. I also see the potential of using stores to also fulfill e-com sales for the local geography it serves. Unlike the other dollar store brands, E-commerce wouldn’t be built as the afterthought or an add on, but rather a core part of the business from day 1.

One of my biggest pet peeves about Home Depot is that they could be offering better cutting services for their customers. Because I’m targeting urban dwellers I see an opportunity to build software on the e-commerce site where customers can easily create a DIY project or select from existing templates and they can than easily can convert these projects instantly into materials and cut lists that get automated by Handy Dollar Dan. I see Handy Dollar Dan using existing and new technology to pre-cut these DIY plans and have them bundled and ready for pick up or delivery with build instructions for the customer. Think decks, fences, gardening boxes, bunk beds, patio furniture, storage, stairs, coffee tablets, etc. I think the DIY revolution is just getting started thanks to new technologies that make it easier than ever for consumers to be creators and builders.

As the cost of same and next day local deliveries gets cheaper thanks to players like Trexity, Bolt Logistics, Swyft etc, I see an opportunity to offer customers very inexpensive to free same day deliveries on orders of $80 or more. And with the rise of the million buy now pay later services I see more flexibility for customers on day one for how they want to finance their DIY project or purchases.

Lastly I see an opportunity to create a dollar brand that treats their employees right, pays them fairly and works relentlessly to reduce the carbon footprint and waste in the renovation industry.

This idea of a category specific dollar store could also make a lot of sense for: Pets, Home Decor/Organization, Arts and Crafts.

Newsletter Disclaimer: Although I obtain information contained in our newsletter from sources I believe to be reliable, I cannot guarantee its accuracy. The opinions expressed in the newsletter are those of Hit and Run, its editors and contributors, and may change without notice. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to be a guarantee for business success, nor constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or that if you start a company inspired from this content that it will not loose money. No recommendation or advice is being given as to whether any the ideas presented or investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your financial adviser prior to making any investments, including whether any investment is suitable for your specific needs.

Category design 🤤

This is great work Sam. 🔥🔥🔥